Concourse – Extended Settlement

Continuous Settlement Processing That Eliminates Legacy Batch Constraints

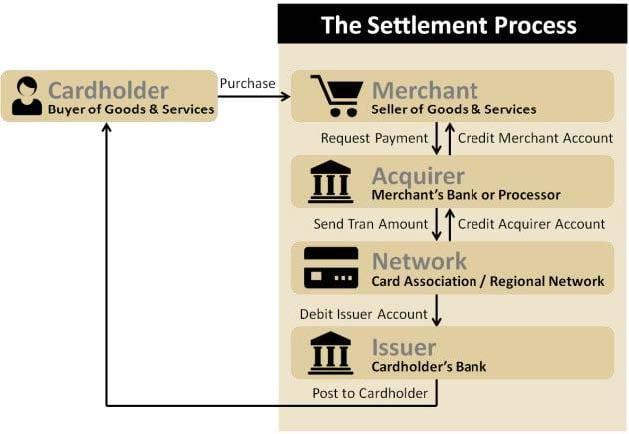

One of the most critical components of processing electronic payment transactions is the successful exchange of funds among the transaction participants.

During the settlement process, all credits and debits associated with each transaction are calculated and netted so that funds can be properly distributed to the appropriate parties. This includes not only the original transaction amount, but also any fees, adjustments, and refunds that occur throughout the transaction lifecycle.

Because settlement directly drives the movement of money, the process must be fully accurate and completed within defined settlement windows to meet network, regulatory, and business requirements.

The Solution

Concourse – Extended Settlement is a proven solution that ensures the settlement of electronic payment transactions is successfully completed. Its configurable rules engine and continuous processing architecture combine to form one of the world’s most flexible, reliable, and cost-effective settlement processing solutions.

Continuous Processing Architecture

Reduce Operational & Financial Risk

- Spread processing throughout the day

- Create funds movement and accounting files

- Offer competitive SLAs for client deliverables

Configurable Rules Engine

Easily Adapt to Change

- Define settlement rules without changing code

- Settle funds based on currency type

- Support multiple settlement schedules

Centralized Transaction Repository

Proactively Monitor Your Business

- View real-time transaction and settlement data

- Access summarizations of settlement outputs

- See real-time net settlement positions

Transactions That Can be Settled by Concourse – Extended Settlement

- Credit, Debit & Prepaid

- ATM & POS

- Internet & Mobile Payments

- Account-to-Account

- Other Emerging Payments

Companies That Can Benefit from Concourse – Extended Settlement

- Regional Networks

- Payment Service Providers

- Merchant Processors

- Issuing Banks

- Acquiring Banks

Key Features & Benefits

Meet Your Business Needs

- Support a variety of distribution methods (e.g., ACH, ISO 20022, AFT, etc.)

- Provide user file for client posting and reconciliation

- Create outputs for internal systems (e.g., billing, general ledger, etc.)

- Provide clients with access to real-time net settlement positions

Configure Your Rules

- Configure any number of distributions and accounts

- Support different settlement windows during the day

- Define settlement rules without changing code

- Align settlement plans based on business model

- Settle according to currency

Monitor Your Money

- Access real-time settlement activity

- View complete life cycle for any transaction

- Analyze real-time online summaries

- Distribute accurate and timely reports

Move from Batch to Real-Time

- Continuously load data from transaction sources

- Spread processing throughout the day

- Speed up settlement cycle

- Meet strict service level agreements

- Reduce unproductive float

System Requirements

- Deployment Environment: Concourse can be deployed on-premise in a client’s data center, or in a private or public cloud environment.

- Hardware: Any hardware that can host a supported Operating System with reasonable performance and responsiveness. Better performance is achieved with faster processors and more memory.

- Web Server: A Java EE-compliant application server. JBoss is recommended.

- Browser: The Concourse user interface is a secure browser-based application. It is compatible with Internet Explorer, Chrome, and Firefox.

- Operating System: Microsoft Windows Server or Red Hat Linux.

- Database: Oracle Enterprise Edition or Microsoft SQL Server Enterprise Edition.

- Virtualization: Optional and supported.

For more detailed information, please request a copy of the Concourse Financial Software Suite Architecture & Technology Guide.

PCI Compliant

The Concourse Financial Software Suite™ is PCI compliant and is listed as a Validated Payment Application at https://www.pcisecuritystandards.org.