Concourse – Reconciliation

Automated, Intelligent Reconciliation of Transaction Data from Multiple Sources

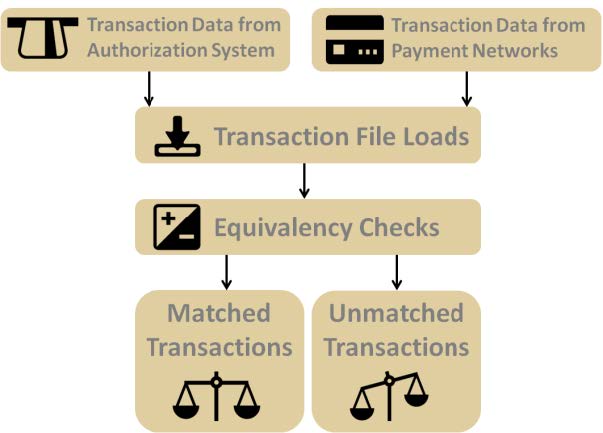

Any company that is processing electronic payment transactions is typically receiving data from multiple data sources. To determine financial equivalency and resolve any discrepancies between the different data sources, a reconciliation process must occur.

A Reconciliation Example

In the example below, data is being received from an authorization system and one or more payment networks (e.g., Visa, Mastercard, Discover).

Since high volumes of transaction information is often being received from many external data sources and each data source may use different business day boundaries, companies are spending a lot of time reconciling transaction data.

The Solution

Concourse – Reconciliation is a real-time, rules-based software solution that automates the reconciliation process. It allows companies to view their current reconciliation status, net positions, suspense items, and specific reasons for any data discrepancies.

Automatic Data Matching

Enhance Operational Efficiency

- Automatically load data from all transaction sources

- Perform attribute reconciliation which matches transaction attribute details between two or more data sources and provides a view of those that failed to match or did not match a transaction from all the data sources.

- Perform balancing reconciliation which compares the financial amount of a transaction between two sources and provides a view into current and previous suspense totals, discrepancies where the financial outcome does not match, and items that expired due to lack of a transaction from one of the sources.

Real-Time Reconciliation

Provide Superior Exception Management

- Review current reconciliation status

- Access suspense items and net positions

- View discrepancies the system has detected

- Resolve using resolution workflows

Transactions That Can Be Reconciled by Concourse – Reconciliation

- Credit, Debit and Prepaid

- ATM and POS

- Internet and Mobile Payments

- Account-to-Account

- Other Emerging Payments

Companies that can benefit from Concourse – Reconciliation

- Regional Networks

- Payment Service Providers

- Merchant Processors

- Issuing Banks

- Acquiring Banks

Key Features & Benefits

Automatic Data Loading & Reconciliation

- Continuously load data from all your transaction sources

- Link data and create complete transaction life cycles

- Reconcile transactions from two or more data sources

- Perform attribute and balancing reconciliation

Rules-Based Reconciliation Plans

- Configure any number of reconciliations

- Leverage rules-based equivalency checks and amount determinations

- Assign reconciliation plans based on transaction attributes

- Reconcile by currency

Real-Time Reconciliation Processing

- Verify real-time reconciliation status and net positions

- Number of transactions processed

- Previous, current, and new suspense items

- Current net position

- Data discrepancies

- Identify discrepancies and unmatched activities in real-time

Proactive Exceptions Management

- Quickly view dates with active problems

- Easily identify the reason for a discrepancy

- Resolve discrepancies using resolution workflows

System Requirements

- Deployment Environment: Concourse can be deployed on-premise in a client’s data center, or in a private or public cloud environment.

- Hardware: Any hardware that can host a supported Operating System with reasonable performance and responsiveness. Better performance is achieved with faster processors and more memory.

- Web Server: A Java EE-compliant application server. JBoss is recommended.

- Browser: The Concourse user interface is a secure browser-based application. It is compatible with Internet Explorer, Chrome, and Firefox.

- Operating System: Microsoft Windows Server or Red Hat Linux.

- Database: Oracle Enterprise Edition or Microsoft SQL Server Enterprise Edition.

- Virtualization: Optional and supported.

For more detailed information, please request a copy of the Concourse Financial Software Suite Architecture & Technology Guide.

PCI Compliant

The Concourse Financial Software Suite™ is PCI compliant and is listed as a Validated Payment Application at https://www.pcisecuritystandards.org.