Concourse – Core: Agile Financial Transaction Processing Software

Fast, Agile Back-Office Processing for Electronic Payment Transactions

Financial services providers must process many different types of electronic payment transactions such as credit, debit, prepaid, ATM, POS, mobile, and account-to-account transactions. As new payment mechanisms have entered the market, companies have been required to access data from a growing number of transaction sources and process these transactions using a variety of back-office systems. As a result, many companies are finding their back-office environments to be difficult to manage, costly to operate, and susceptible to performance issues and errors.

The Solution

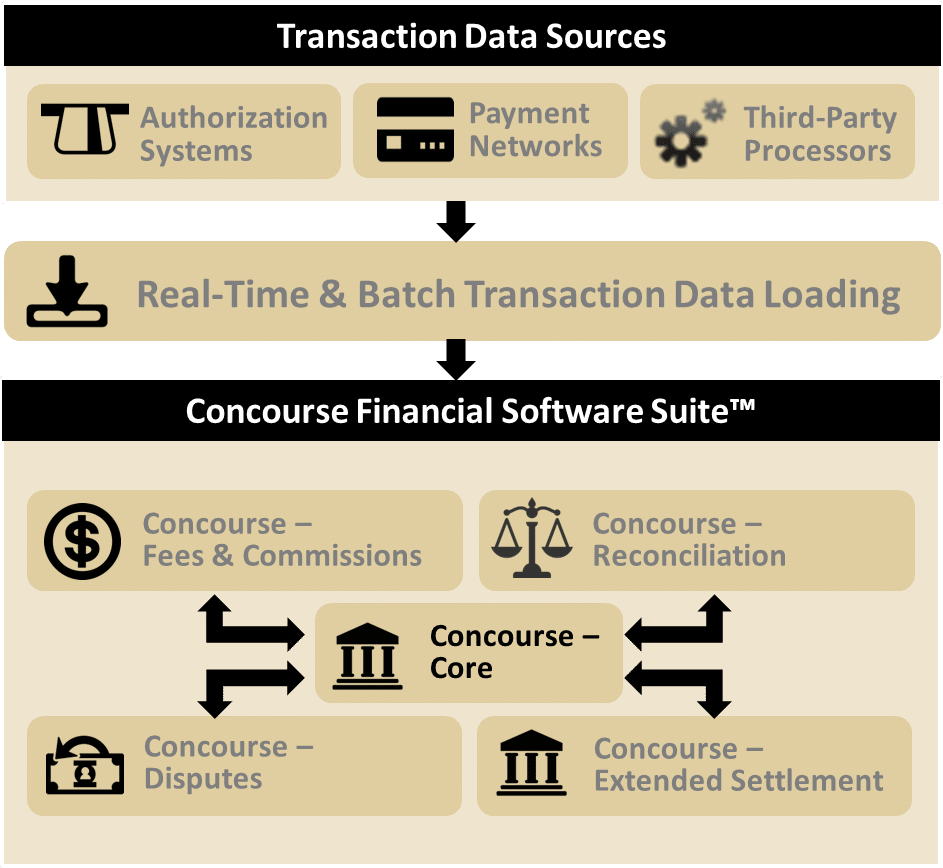

The Concourse Financial Software Suite™ is an integrated software suite specifically designed to perform back-office processing for electronic payment transactions. It includes the following modules:

The Concourse Financial Software Suite is designed as an integrated back-office system, but its modular design allows companies to select and add appropriate business services as they are needed.

Concourse – Core

Concourse – Core is the heart of the Concourse Financial Software Suite because it provides the foundational functionality leveraged by all other Concourse modules:

- Continuous Processing Architecture

- Centralized Transaction Repository

- Real-Time Data Processing and Access

- Configurable Rules Engine

- Version and Operations Management

Here is an illustration of data being automatically loaded into the Concourse system and shared with the Concourse modules via Concourse – Core.

Benefits of the Concourse Financial Software Suite

- Improve operational efficiency by automatically loading data from all your transaction sources

- Proactively monitor your business with real-time access to current transaction data and processing activity

- Enhance productivity and easily meet changing needs with configurable rules engine

- Win more business with competitive fee schedules and commission programs

- Ensure data integrity by automatically identifying discrepancies and reconciling transaction data

- Reduce the cost and complexity of managing chargebacks and disputes

- Meet service level agreements with fast and accurate settlement processing

Key Features & Benefits

Centralized Transaction Repository

- Consolidate up-to-the-minute data from multiple sources into a single trusted view

Continuous Processing Architecture

- Begin processing the moment the source data is available

Transaction Lifecycle Linkage

- Link data to create complete view of transaction

Real-Time Data Access

- Access transactions in real-time via browser-based viewer

Multi-Tenant User Access

- Provide secure access to business clients and processors

Configurable Rules Engine

- Easily configure system to meet current and future needs

Real-Time Summaries & Reporting

- Proactively track the status of payments across the entire enterprise

Version Management

- Schedule future changes in a controlled manner

Operations Management

- Ensure reliable processing and data management

Scalability and Availability

- Have peace of mind that Concourse can adapt and scale to handle increased transaction volumes

System Requirements

- Deployment Environment: Concourse can be deployed on-premise in a client’s data center, or in a private or public cloud environment.

- Hardware: Any hardware that can host a supported Operating System with reasonable performance and responsiveness. Better performance is achieved with faster processors and more memory.

- Web Server: A Java EE-compliant application server. JBoss is recommended.

- Browser: The Concourse user interface is a secure browser-based application. It is compatible with Internet Explorer, Chrome, and Firefox.

- Operating System: Microsoft Windows Server or Red Hat Linux.

- Database: Oracle Enterprise Edition or Microsoft SQL Server Enterprise Edition.

- Virtualization: Optional and supported.

For more detailed information, please request a copy of the Concourse Financial Software Suite Architecture & Technology Guide.

PCI Compliant

The Concourse Financial Software Suite™ is PCI compliant and is listed as a Validated Payment Application at https://www.pcisecuritystandards.org.