Concourse – Fees & Commisons

Gain A Competitive Advantage

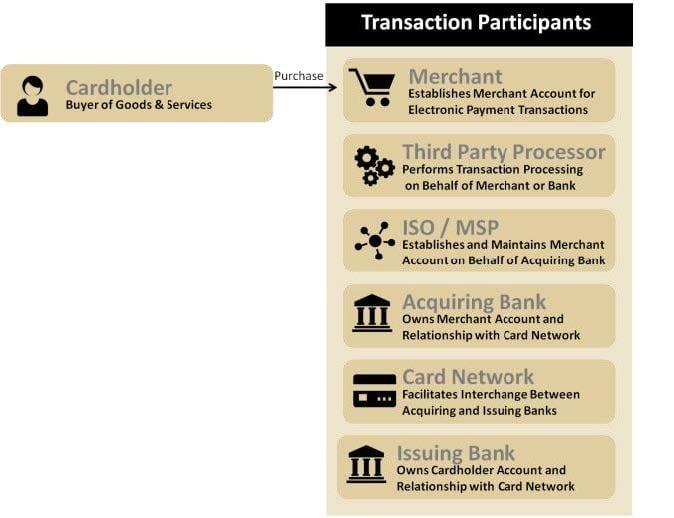

When a cardholder makes a purchase, there are usually numerous parties involved throughout the electronic payments process. The diagram below lists some of the participants that may be involved:

Due to rapid growth in the electronic payments industry, all the above payment service providers are experiencing fierce competition. To be successful, these companies must respond to changes in the marketplace very quickly. They must also be able to continuously change fees, commissions, and pricing structures based on specific business relationships.

The Solution

Concourse – Fees & Commissions is a real-time, rules-based software solution that gives companies the flexibility to calculate any type of fee or commission on any electronic payment transaction, and base each calculation on specific business relationships.

Centralized Transaction Repository

Access to All Transaction Data Elements

- Automatically load transactions from all data sources into a centralized repository

- Leverage transaction data elements from one to many sources to calculate fees and commissions

Configurable Rules Engine

Have Complete Control & Flexibility

- Configure fee and commission schedules based on specific business relationships

- Assess one to many fees or commissions per transaction

- Support recurring fees that are billed once per period

- Implement flat or tiered pricing structures

Online Auditing & Reporting

Continually Monitor Your Business

- Initiate trial runs to evaluate financial impact of alternative pricing structures

- View fees and commissions assessed for each transaction via secure browser-based user interface

Companies That Can Benefit from Concourse – Fees & Commissions

- Third Party Processors

- Payment Service Provider (PSP)

- Independent Service Organizations (ISO)

- Merchant Service Providers (MSP)

- Acquiring Banks

- Card Networks

Have Complete Control & Flexibility of Your Fees, Commissions & Pricing Structures

|

|

The Options are Unlimited

Key Features & Benefits

Automatic Data Loading

- Continuously load data from all your transaction sources

- Calculate any type of fee or commission using data from multiple transaction data sources

Rules-Based Configuration

- Leverage any transaction data element to configure specific types of fees and commissions

- Implement a wide range of pricing structures (e.g., transaction-based, volume-based, flat, tiered)

- Define an unlimited number of fees and commissions based on specific business relationships

- Assess one to many fees or commissions per transaction or period

- Support fee assessment in different currency codes

- Establish unique fee assessment periods for clients (e.g., daily, weekly, monthly, quarterly, annually)

- Easily configure and modify rate structures via a browser-based business rule generator

Real-Time Fee Assessment

- Access fee activity in real-time via browser-based viewer

- Evaluate fee exceptions and initiate corrections

- Initiate trial runs to see impact of new rate schedules

- Audit external fees by calculating expected fees and comparing results

- Review reports for all settled fees and fee audits

- Provide online fee summaries and statements to clients

System Requirements

- Hardware: Any hardware that can host a supported Operating System with reasonable performance and responsiveness. Better performance is achieved with faster processors and more memory.

- Web Server: A Java EE-compliant application server. JBoss is recommended.

- Browser: The Concourse user interface is a secure browser-based application. It is compatible with Internet Explorer, Chrome, and Firefox.

- Operating System: Microsoft Windows Server or Red Hat Linux.

- Database: Oracle Enterprise Edition or Microsoft SQL Server Enterprise Edition.

- Virtualization: Optional and supported.

For more detailed information, please request a copy of the Concourse Financial Software Suite Architecture & Technology Guide.

PCI Compliant

The Concourse Financial Software Suite™ is PCI compliant and is listed as a Validated Payment Application at https://www.pcisecuritystandards.org.