Concourse – Fees & Commisons

Powerful, Rules-Based Fee Management for Revenue Optimization and Growth

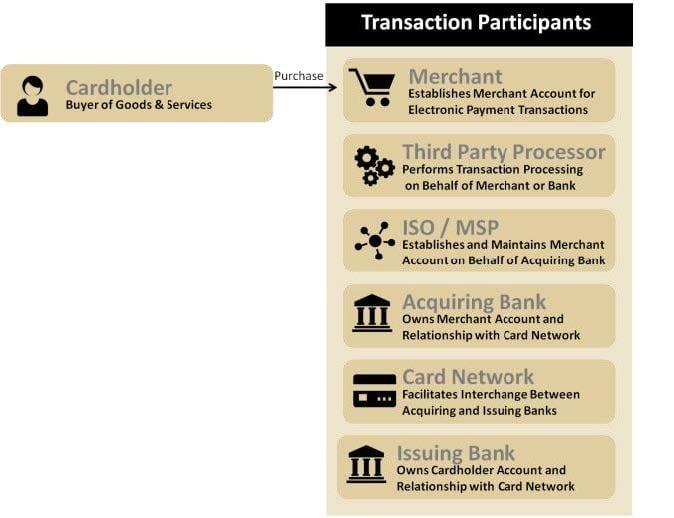

When a cardholder makes a purchase, there are numerous parties involved throughout the electronic payments process. The diagram below lists some of the participants that may be involved:

Due to rapid growth in the electronic payments industry, all the above payment service providers are experiencing fierce competition. To be successful, these companies must respond to changes in the marketplace rapidly. They must also be able to continuously change fees, commissions, and pricing structures based on specific business relationships.

The Solution

Concourse – Fees & Commissions is a real-time, rules-based software solution that gives companies the flexibility to calculate any type of fee or commission on any electronic payment transaction. It can use any combination of transaction attributes and base each calculation on specific business relationships.

Centralized Transaction Repository

Access to All Transaction Data Elements

- Automatically load transactions from all data sources into a centralized repository

- Leverage transaction data elements from one to many sources to calculate fees and commissions

Configurable Rules Engine

Have Complete Control & Flexibility

- Configure an unlimited number of fee types

- Assess one to many fees per transaction

- Implement flat, tiered, periodic, and recurring fees in any currency

- Create fee models that are based on specific business relationships

Real-Time Viewing and Assessment

Continually Monitor Your Business

- Access real-time fee activity via a secure browser-based viewer

- Measure the impact of proposed fee changes

- Manage exceptions and corrections related to fees

Companies That Can Benefit from Concourse – Fees & Commissions

- Third Party Processors

- Payment Service Provider (PSP)

- Independent Service Organizations (ISO)

- Merchant Service Providers (MSP)

- Acquiring Banks

- Card Networks

Have Complete Control & Flexibility of Your Fees, Commissions & Pricing Structures

|

|

The Options are Unlimited

Key Features & Benefits

Automatic Data Loading

- Continuously load data from all your transaction sources

- Calculate any type of fee or commission using data from multiple transaction data sources

Rules-Based Configuration

- Configure an unlimited number of fee types (e.g., interchange, network, processing, etc.)

- Leverage rules engine to expose all transaction attributes for use in qualifying decisions

- Support flat, tiered, tiered and period in any currency

- Generate fees on businesses that are directly or indirectly related to a transaction

- Support the passthrough or sharing of network fees

- Establish unique fee assessment periods for clients (e.g., daily, weekly, monthly, quarterly, annually, etc.)

Real-Time Fee Assessment

- Access real-time fee activity via a secure browser-based viewer

- Measure impact of proposed fee changes

- Manage exceptions and corrections related to fees

- Provide clients with access to their fee summaries in real-time

System Requirements

- Deployment Environment: Concourse can be deployed on-premise in a client’s data center, or in a private or public cloud environment.

- Hardware: Any hardware that can host a supported Operating System with reasonable performance and responsiveness. Better performance is achieved with faster processors and more memory.

- Web Server: A Java EE-compliant application server. JBoss is recommended.

- Browser: The Concourse user interface is a secure browser-based application. It is compatible with Internet Explorer, Chrome, and Firefox.

- Operating System: Microsoft Windows Server or Red Hat Linux.

- Database: Oracle Enterprise Edition or Microsoft SQL Server Enterprise Edition.

- Virtualization: Optional and supported.

For more detailed information, please request a copy of the Concourse Financial Software Suite Architecture & Technology Guide.

PCI Compliant

The Concourse Financial Software Suite™ is PCI compliant and is listed as a Validated Payment Application at https://www.pcisecuritystandards.org.